2025 China Packaging and Printing Industry Analysis

In recent years, China's economy has continued to grow, and market demands for packaging and printing quality and techniques have risen sharply. Within just a few years, packaging and printing has become a "hotspot" in the printing market.

Products all require packaging, making this industry one of the fastest-growing sectors. Rapid growth and vast development potential have attracted more businesses to enter the field. Below is an analysis of China’s packaging and printing industry in 2025.

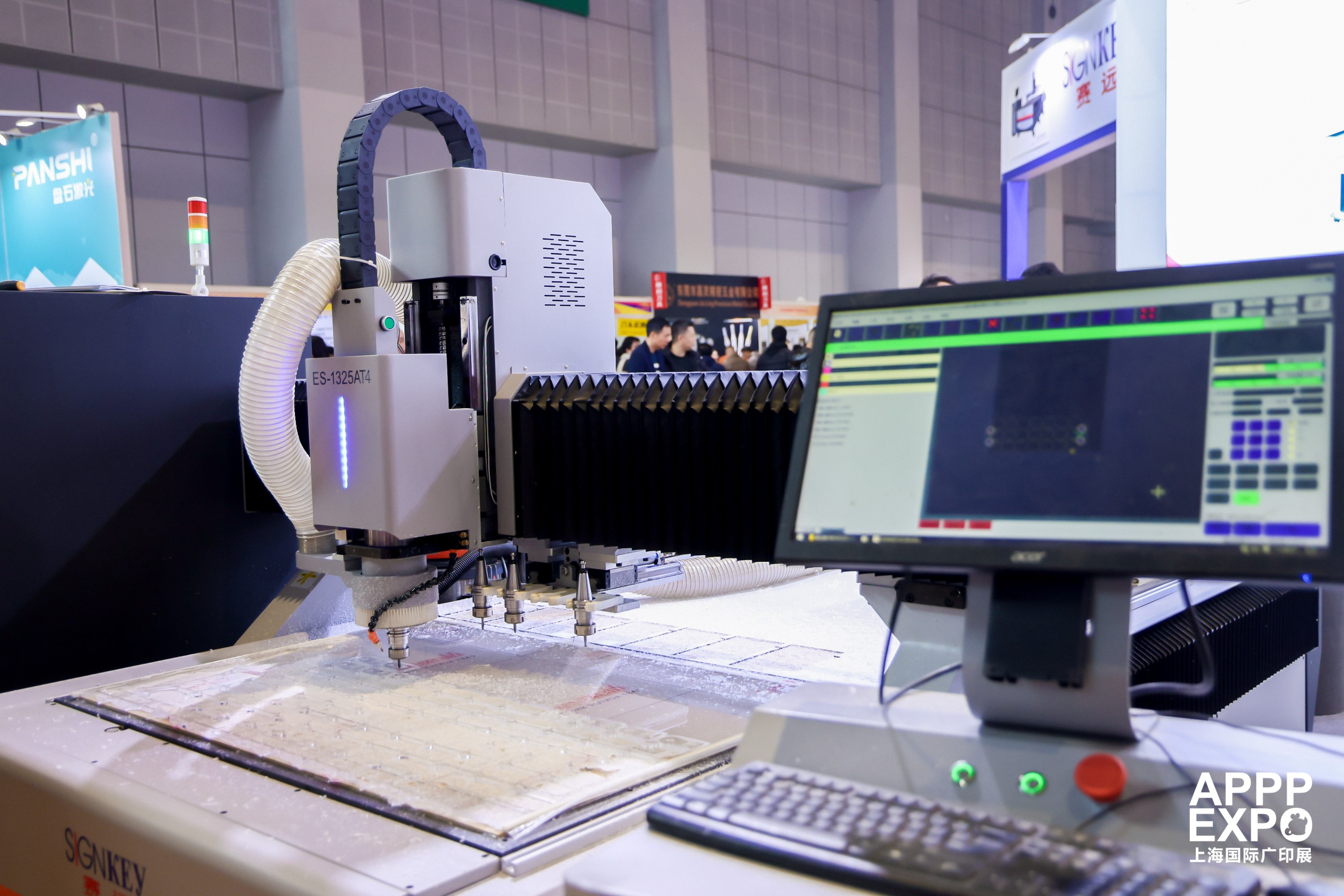

Technology Trends

AI-Driven Smartization:

AI technology will see broader and deeper applications in printing. It will optimize quality control and automated workflows, while also playing key roles in predictive maintenance, quality management, cybersecurity, supply chain management, and logistics. This will boost productivity, sustainability, and profitability for businesses.

Inkjet Printing for Sustainability:

Inkjet printing will expand further, driven by demand for small-batch production, fast turnaround, and eco-friendly practices. Upgrading printing processes will become a priority, with companies focusing on recycled materials and energy-efficient manufacturing.

Digital Printing Powers Customization:

Digital printing supports personalized packaging needs. Businesses can quickly create unique designs tailored to consumer groups, cultural trends, or marketing campaigns—like holiday-themed food packaging or artist-collaboration designs for cultural products.

Market Trends

Industry Consolidation Accelerates:

In 2025, mergers and acquisitions will intensify as companies adjust their scale and expand operations to meet future demands.

Demand Rises with Consumer Recovery:

As consumer markets rebound, packaging demand will grow—especially in electronics, pharmaceuticals, food, and cosmetics—creating opportunities for businesses.

Competitive Landscape

Company Size and Regional Clusters:

As of August 2023, China had 11,089 packaging and printing companies, mainly in plastics, paper, metal, glass, and cork. The industry is clustered in three major regions: the Pearl River Delta, Yangtze River Delta, and Bohai Rim, with Guangdong Province having the most businesses.

Large Companies Dominate:

Big firms lead with advanced technology, economies of scale, and comprehensive services. They adapt quickly to market changes and meet diverse client needs.

Challenges for Small and Medium Enterprises (SMEs):

SMEs face hurdles due to limited resources, product homogeneity, and weaker competitiveness. To survive industry consolidation and digital transformation, they must improve innovation and technical capabilities.

Policy and Sustainability

Green Policies Drive Eco-Friendly Shifts:

Strict environmental regulations are pushing the industry toward sustainability. Companies are investing in digital technologies and developing recyclable, eco-friendly materials to reduce environmental impact.

Government Support:

Policies like the National Printing Demonstration Enterprise Management Guidelines encourage innovation and high-quality development. These aim to steer the industry toward smart manufacturing, specialization, and tech-driven growth.

Future Outlook

By 2025, AI and digital printing will accelerate smart, sustainable development in the industry. Consolidation will continue as companies grow through mergers. Despite challenges like economic uncertainty and labor shortages, trends in smart technology, customization, and green practices will create new opportunities for growth.