Wide-format Print Industry Service Report 2023

Introduction

In the previous issue, we shared the textile printing and dyeing market; in this issue, we will focus on the wide-format printing market.

With the strong support of the China Sign Association (CSA) and Keypoint Intelligence from the United States, we have conducted an in-depth observation of the ongoing development trends in China's wide-format printing industry, collecting feedback from 1,532 industry professionals. Below, we will share with you our main insights into the continuous development trends of China's wide-format printing industry in 2023.

Wide-format Print Industry Service Report

The respondents to the survey hold various job titles within their companies, ranging from general managers to IT managers. The survey revealed that a significant number of respondents are involved in sales and marketing roles (33%), followed by IT managers (17%) and CEOs (15%).

Most companies surveyed are small-scale operations, with 47% of companies employing between 20 to 99 employees. Notably, there are also a substantial number of large-scale operations, with 22% of companies employing 100-500 employees.

1. Analysis

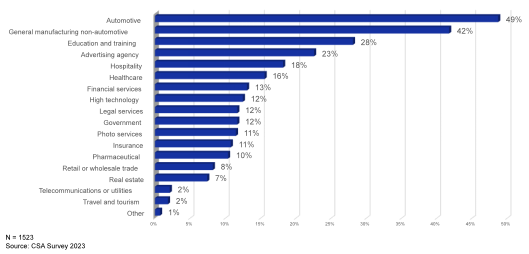

Survey respondents were first asked about the vertical industries they served, as shown in the figure below.

Automotive and Education/training remain at the top as was in previous years, however General Manufacturing (non-automotive) has replaced Advertising Agencies to round out the top three industries served.

Figure 1: Primary Vertical Industries

When survey participants were asked to specify the single category that accounted for the greatest share of their company’s revenues the breakdown was as follows:

◆In-Plant Print Operations: 49% (2022-26%)

◆Screen Printer/Sign & Display PSPs: 21% (2022-18%)

◆General Commercial Printer: 8% (2022-16%)

◆Sign Shop: 14% (2022-14%)

In our previous 2022 survey, 32% of the businesses surveyed were sign and graphics companies, either sign shops or screen-print sign & display companies. For 2023, trends seem to be moving towards specialty printing business models. While businesses focused on signs and graphics increased to 35%, In-plants nearly doubled from 26% to 49%. Conversely, commercial printers dropped from 16% to 8%.

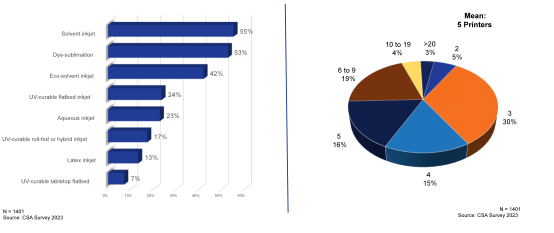

Wide format PSPs’ equipment choices continue to lean towards solvent, eco-solvent inkjet dye-sublimation. On average, respondents reported owning about 5 devices. This is down from an average of 7 devices in 2022.

Figure 2: Digital Wide Format Printers Owned

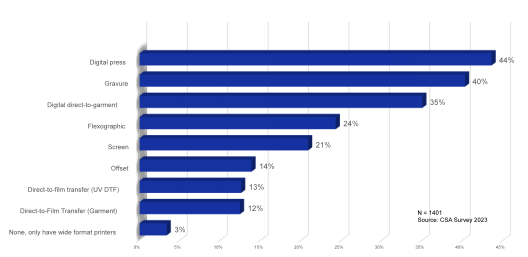

In addition to wide format equipment, sign & display PSPs also had a variety of other devices at their shops. Offset, Gravure, and DTG are the top examples of how PSPs offer a variety of services.

Figure 3: Non-Wide Format Equipment Owned

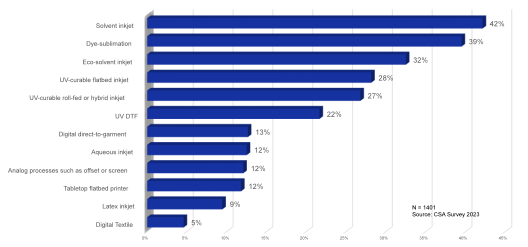

Interest in latex, solvent, and eco-solvent has eased a bit while interest in sublimation has grown 9% to 49%. While Solvent/Eco-solvent remains the most prevalent technology, UV curable popularity is gaining interest and UV DTF is one of the devices planning to be purchased in the next 2 years. Another interesting fact is that analog offset or screen devices have increased from 3% in 2022 to 12% in 2023.

Figure 4: Wide Format Purchasing Plans

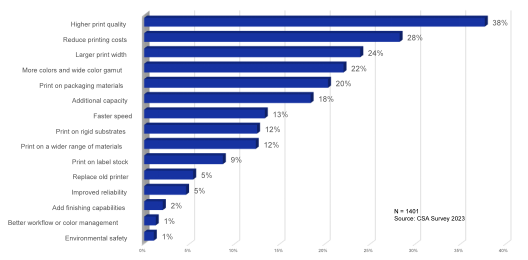

The top driver for purchasing new wide-format printers and finishing equipment has shifted a bit. There is still a strong desire to reduce costs, 28%, and higher print quality has now become the most important factor in determining a future purchase. The desire for better quality and wider color gamut shows that the China-wide format market is maturing and growing into a premium market space. Price and cost will always be a factor, but quality will allow for higher profitability for PSPs.

Figure 5: Drivers for Purchasing New Equipment

Print volume in 2023 has slowed down compared to previous years. While 23% say volume has remained the same and 26% are showing increased volumes, 50% are showing a drop in volume. 23% of those show decreased levels between 6% and 10%.

Figure 6: Change in Print Volumes

UV DTF is continuing to grow in the China domestic market. 12% of those surveyed stated they are utilizing UV DTF with an average investment price of ¥ 100k ($14K) per device. The average number of devices per PSP is six machines.

For PSPs utilizing UV DTF, 60% of respondents claim that it provides between 25% and 75% of their overall revenue.

Figure 7: UV DTF Revenue Percentages

2. Print Production Workflow and Software

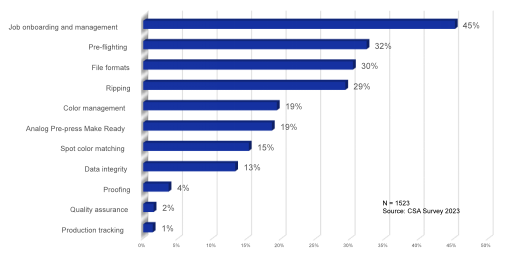

As was the case in 2022, job onboarding remains the top challenge for PSPs, in 2023, when it comes to production workflow. The concern seems to be decreasing a bit from 62% in 2021 to 54% in 2022, and now 45% in 2023. Workflow is an ongoing issue for many organizations, which stands to reason when so many of them are producing a wide variety of items for a diverse group of industries.

Figure 8: Print Production Workflow Challenges

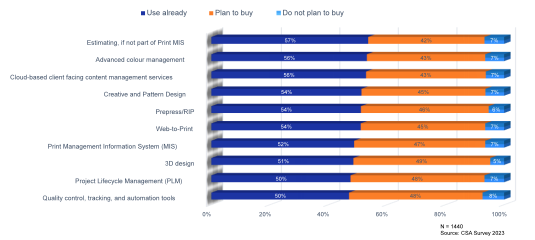

Print MIS and estimating software have continued to increase in relevance over the last 2 years. Up 8% from last year, 57% of PSPs in 2023 are now utilizing these solutions to streamline the job onboarding challenges many businesses reported in the previous figure. It is important to note, that while it is difficult to add new systems and simultaneously meet demand increases, a continued movement towards automated job onboarding and production processes will increase profitability as volume scales up.

Figure 9: Software Investment Plans

These top three items show that the Chinese domestic market is evolving to allow for products to be positioned as a service sold at a premium price instead of a commodity where the only advantage is a lower price.

While sustainability remains a priority in all aspects of business, customer demand has shifted slightly to value an expanded range of products and 3D garment design. Color consistency rates highly as well and environmentally friendly processes continue to be important.

SUMMARY

The 2023 CSA Survey provides valuable insights into the current state and future direction of China's wide-format print industry. Key findings underscore the importance of operational efficiency, technological adoption, and sustainability. As businesses navigate the future, they must remain agile and responsive to market changes.

The data suggests that while the industry faces significant challenges, there are also numerous opportunities for growth and innovation. Companies that prioritize quality, customer service, and unique product offerings are well-positioned to succeed in an increasingly competitive market. Moreover, the gradual shift towards UV DTF and digital display advertising services indicates potential new revenue streams that could redefine the industry in the coming years.

Ultimately, the future of China's wide-format print industry will depend on its ability to adapt to technological advancements, market demands, and sustainability trends and make informed decisions to foster growth and ensure long-term success in a rapidly evolving marketplace.